Bitcoin Price Prediction: BTC Eyes $60k On Ballistic 38% Pump In A Month As Fidelity Sees Bitcoin Market Cap At $1.5 Trillion, And The BlackRock BTC ETF Hits Insane Volumes

The Bitcoin price has soared 5% in the last 24 hours to trade for $59,339 as of 5:05 a.m. EST time.

With this surge, BTC is eyeing the $60,000 milestone, a level last tested on November 18, 2021.

Notably, trading volume has dropped around 8%, suggesting investors are shying away from the market. One possible reason is the enhanced risk, with some analysts saying the king of cryptocurrency is at the cusp of a correction.

I've closed all my #long contracts now, my $BTC trigger profit at $56,300. I hope my followers have also managed to close their long position.

Given the increased risk and higher fees associated with Long contracts, it's crucial we control our #risks carefully.#BTC #contracts pic.twitter.com/3omgotsgHM

— Cily🌵咕噜小姐𐤊🍹 (@CreationFanatic) February 27, 2024

Amid elevated risk levels in the BTC market, experts say a correction could see up to $300 million positions liquidated.

$300 Million Risks Liquidation If BTC Drops Beneath Key Level#bitcoin #BTC #tafouio #cryptonews pic.twitter.com/Sj7oOvf5cS

— tafou.io (@tafouio) February 28, 2024

As reported on Tuesday, the main driver in the market now is FOMO, the fear of missing out. This follows a voluminous BTC purchase by MicroStrategy and explosive capital inflows into the BTC market. The exchange-traded funds (ETFs) narrative instigates the latter theme.

Some analysts anticipate even more FOMO, especially once the Bitcoin price passes the $60,000 milestone. This could blow millions of shorts out of the water, effectively liquidating them. If this happens, it could be the factor that catapults BTC to reclaim its all-time high of $69,000.

FOMO is going to start after 60k$ and that will be our zone to risk off and transfer atleast 50% of the profits made to spot.

Don't be too greedy & get trapped in FOMO.

Follow me and I will make you exit near top the same way I made you buy near bottom.#BTC #Bitcoin #Bulls

— 24 Crypto.Info (@24Crypto_Info) February 28, 2024

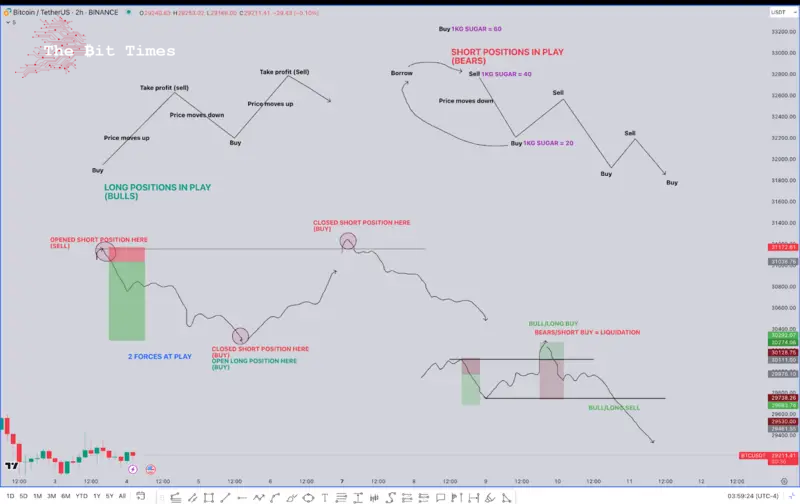

Dynamics Of Why Shorts Could Send Bitcoin Price Further North

If the price goes up, the stop losses of shorts are hit. In response, they buy, effectively opening new positions, with the ensuing buyer momentum propelling the Bitcoin price further north. When price goes down, the take profits of shorts are hit, so they sell, leading to an extended fall.

This is unlike the longs, who sell when their profits are hit during an uptrend, causing a price drop. The reverse is true, in that during a downtrend, their stop losses are hit, so they buy, fueling a recovery.

Meanwhile, Galaxy Digital CEO Mike Novogratz believes the Bitcoin price is in a discovery phase as Wall Street can now access the investment product. This is amid an ongoing frenzy about the spot ETFs that have brought BTC to the US wealth.

$BTC is in price discovery phase. Maybe really for the first time since it’s been an asset as now the bulk of US wealth has easy access. Hard to predict where we stop.

— Mike Novogratz (@novogratz) February 28, 2024

Despite elevated risk levels and growing FOMO, an analyst from Fidelity, which issues the FBTC ETF, says BTC could record $1.5 trillion market capitalization soon. If it happens, it would constitute a 29% move north from the current $1.16 trillion.

🔥Fidelity Suddenly Issues Huge $1.5 Trillion Prediction As ‘Parabolic’ Bitcoin Price Surge Boosts Ethereum, XRP And Crypto #BTC #Bitcoin 🚀🚀🚀🚀🚀🚀🚀🚀 https://t.co/eIaSS2Bk4r

— 💎Macro Maxwell 💎💰💰💰 (@MacroMaxwell) February 27, 2024

Elsewhere, BlackRock has seen its IBIT ETF record insane volumes, going past the Monday headline of $1.3 billion. On Tuesday, trading volumes for the IBIT ETH skyrocketed to $1.35 billion, breaking its previous day’s record with a 3.8% surge on the day.

Another intense volume day for the Nine with well over $2b traded. $IBIT broke its personal record again w/ $1.3b (for context that's more than most large cap US stocks trade). I don't know if this is a new normal or some kind of short-term algo/arb-related burst a la $HODL. pic.twitter.com/KkCkdQKe9r

— Eric Balchunas (@EricBalchunas) February 27, 2024

Bitcoin continues to be a headlining topic in the cryptocurrency investment market, with expectations for even more gains. This is as the countdown to the halving continues, standing 52 days out, according to estimates by CoinGecko.

Bitcoin Price Outlook As BTC Halving Draws Near

There is no second though to the fact that the bitcoin price is at high risk of a correction. First, BTC is already massively overbought, as seen with the Relative Strength Index (RSI) position at 79. Also, The Spent Output Profit Ratio (SOPR) is way above the 1 threshold, at 3.59 as of the time of writing. Whenever the SPOR is above 1, it means that the owners of the spent outputs are in profit at the time of the transaction.

However, with the RSI still northbound, the bulls are not showing any signs of stopping and are increasing their buyer momentum.

If they have their way, the Bitcoin price could extend a neck higher to the $60,000 milestone, likely at the break of the New York session.

For a chance to reclaim its $69,000 peak, however, Bitcoin price must manage a candlestick close above $65,664. This is the mean threshold of the supply zone extending from $63,329 and $67,999. For the layperson, a supply zone is an area where aggressive selling is expected because of the dense seller population. Research has shown that a break and close below the midline of a supply barrier confirms the continuation of the intermediate (1-day timeframe) trend.

TradingView: BTC/USDT 1-day chart

Converse Case

If profit booking overpowers buying pressure, however, the Bitcoin price could retract, likely descending past the $55,000 threshold and the $50,000 milestone. In a dire case, the downtrend could see BTC retest the $40,000 psychological level for a quick sweep of the liquidity that remains below this level.

A daily candlestick close below $40,000, effectively delaying the pullback, could see the Bears take over the market. Such a move could send the Bitcoin price to the $30,000 psychological level.

However, while the BTC market is hot with the Bitcoin price at high risk of a correction, savvy investors are spreading their risk with this new ICO, Green Bitcoin. Some analysts rank it as among the best penny crypto investments, while crypto analyst and YouTuber Jacob Bury rates it one of the best crypto altcoins to buy before the 2024 Bitcoin halving.

Promising Alternative To Bitcoin

Green Bitcoin, powered by the GBTC token, comes to you amid a trending Bitcoin market, meeting users where the legacy of Bitcoin merges with the eco-friendly attributes of Ethereum. It is a predict-to-earn project that introduces the revolutionary Gamified Green Staking mechanism.

As #Bitcoin approaches all-time highs, everyone on your feed is making predictions.

But Green Bitcoin is the only place where you can STAKE and EARN on those predictions! pic.twitter.com/yGgux4u9b9

— GreenBitcoin (@GreenBTCtoken) February 16, 2024

Here, participants enjoy exponential rewards and up to 100% token bonuses for the fresh challenges presented live every week. Specifically, there are daily and weekly BTC price prediction challenges, with the potential to earn attractive rewards.

The experts weigh in on GBTC!

Bitcoin Price to Hit $200,000 by 2025: Standard Chartered – Can Green Bitcoin Outperform BTC?https://t.co/w2mT4kp0fo

— GreenBitcoin (@GreenBTCtoken) February 19, 2024

Green Bitcoin also offers a unique, sustainable staking model called ‘Gamified Green Staking’, which allows users to earn passive income through staking rewards.

Did you know you can earn HUGE, simply by staking your Green Bitcoin?

If you haven't yet, go to our website and check out the Staking feature! pic.twitter.com/6wiv99ER0O

— GreenBitcoin (@GreenBTCtoken) February 25, 2024

Investors looking to buy GBTC can do so on the official website, where it is selling for $0.4982. This price tag will only last for the next four days before a price hike. So far, presale sales have reached upwards of $1.18 million, out of a target objective of $1.247 million. Get yours today before the price increases in a little more than four days.

NEW STAGE IS LIVE!

Join the Green Revolution before it's too late! pic.twitter.com/tptpN72nNo

— GreenBitcoin (@GreenBTCtoken) February 23, 2024

Visit and Buy GBTC here.

Also Read:

- Top Cryptos with Potential for 10x Returns in 2024 – Green Bitcoin, Scotty the AI, and Frog Wif Hat

- Bitcoin Price Prediction: BTC Soars 9% To Highest In 27 Months As BlackRock’s Bitcoin ETF Hits Record $1.3 Billion Inflow – Time To Buy BTC?

- Why You Should Check Out Green Bitcoin (GBTC) – The Next 50x Token Taking The Market By Storm

- Green Bitcoin (GBTC) Is A Token You Don’t Want To Miss Out – Learn About Its Gamified Green Staking

Category: Cryptocurrency News

Post by: TheBitTimes.com

Comments

Post a Comment