OpenAI o1 predicts Bitcoin price for the 2024 ‘Uptober’

Since 2013, Bitcoin (BTC) has experienced positive returns in October for nine out of eleven years, rendering the “Uptober” moniker. As September ends, Finbold turned to OpenAI’s artificial intelligence (AI) model, o1, for a price prediction based on historical results.

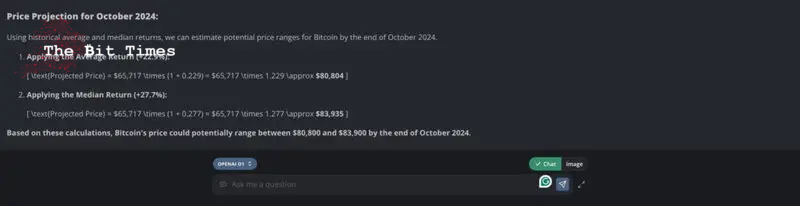

The o1 AI – deemed one of the world’s most advanced models – calculated a potential price for Bitcoin in 2024’s “Uptober.” For that, OpenAI’s o1 used the average and median monthly historical results from October’s opening to closing prices.

As a result, o1 predicts BTC will trade between $80,800 and $83,900 by the end of the month. This forecast considers an opening price of $65,717, as we prompted the exchange rate at the time of writing.

Picks for you

Bitcoin’s Uptober historical results

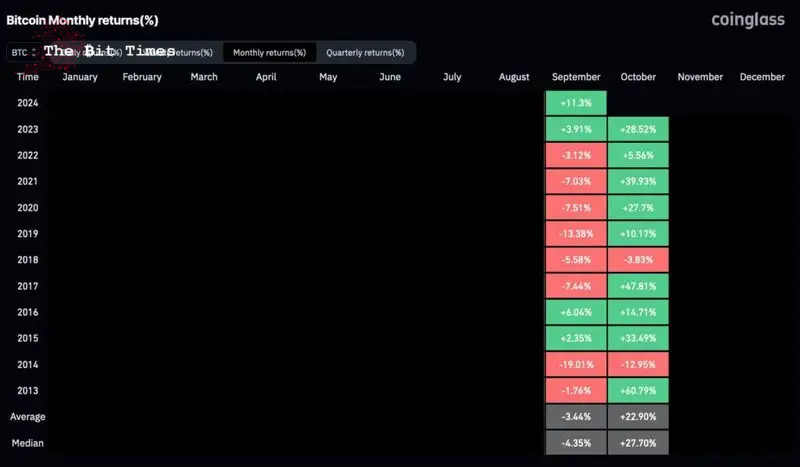

Interestingly, while October has historically positive returns, September is dominated by negative returns, also known as the “September Effect.” The market has then seen “Uptober” as a month of investing opportunities with notable results for the leading cryptocurrency.

Notably, the only two negative years registered moderate losses of 3.83% and 12.95% in 2018 and 2014, respectively. Meanwhile, 2013, 2017, 2021, and 2023 had massive gains of 60.79%, 47.81%, 39.93%, and 28.52%, respectively.

This year, 2024, Bitcoin had its fourth halving, an important event for BTC investors, traders, and miners, changing its economics. Previous halving years were 2020, 2016, and 2012, registering “Uptober” gains of 27.7% and 14.71%.

On average, October has returned 22.90% to traders who bought on the first day and sold on the last. The median results are even higher, nearing 28% gains, according to data Finbold retrieved from CoinGlass on September 29.

Bitcoin (BTC) price analysis

Bitcoin price is on the rise, already up from when we prompted OpenAI’s o1 for the “Uptober” prediction. Right now, BTC trades at $65,870 against the dollar, up 56.07% year-to-date, although displaying a six-month downtrend.

However, while most market participants expect an overall positive October, the volatility can still hit in the meantime. Traders and investors must remain cautious as the month develops and avoid overexposure in leveraged positions without proper risk management.

These positions create liquidity pools that Bitcoin first needs to clear before moving to its next targets. In counterpoint, data still shows a significantly low interest in Bitcoin, similar to levels seen in the previous bear market.

Comments

Post a Comment